March 03, 2025

Please Note

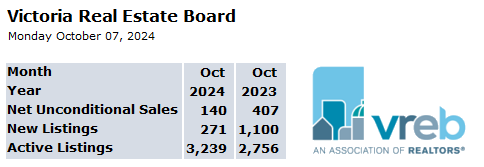

Left Column: shows final counts for all property types for the month just ended

Right Column: shows final counts for all property types for the same month last year

February a steady month for Greater Victoria buyers and sellers

March 3, 2025 A total of 528 properties sold in the Victoria Real Estate Board region this February, 12.3 per cent more than the 470 properties sold in February 2024 and 25.1 per cent more than in January 2025. Sales of condominiums were up 26.3 per cent from February 2024 with 192 units sold. Sales of single family homes increased by 4.5 per cent from February 2024 with 234 sold.

"February was another stable month for local real estate," said 2025 Victoria Real Estate Board Chair Dirk VanderWal. "The combination of slowly growing inventory and slightly increased sales means that our market remains in balance from the start of the year, which creates comfortable conditions for both buyers and sellers. Nearly two years of steady prices combined with recent favourable interest rates are positive factors for our market. Thus far, 2025 has been a good year to buy and sell."

There were 2,630 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of February 2025, an increase of 9.8 per cent compared to the previous month of January and an 11.3 per cent increase from the 2,364 active listings for sale at the end of February 2024.

"In these market conditions properties need to be well presented and properly priced to be successful," adds Chair VanderWal. "We are following our typical early spring market cycle, which generally speaking peaks in late spring. Hopefully in the upcoming weeks we'll see more inventory enter the market to meet consumer demand. We will also watch what impacts any changes to global economic policies may have on our market if and when they occur. Right now, there are many factors that impact your housing decisions, and your favourite local REALTOR® is ready to help you navigate the current market."